Table of Contents

Why This CPM Comparison Matters in 2026

If you lead finance , you already know the truth: CPM is no longer “nice-to-have” software. It is the system that decides whether your team spends the month explaining numbers or driving decisions.

Close cycles keep getting squeezed. Forecasts are questioned more often. Business leaders want answers in hours, not in “the next planning round.” Meanwhile, finance teams are expected to do more scenario work, more governance, more compliance, and more cross-functional collaboration without adding headcount.

That is why the OneStream vs. Oracle Hyperion vs. Anaplan question keeps coming up. These platforms sit at the center of how modern finance plans, closes, consolidates, and reports. But they are not interchangeable, and in 2026 the “best” option depends heavily on your reality: your data shape, your entity complexity, your planning culture, and your future roadmap.

In this article, we’ll compare OneStream, Oracle Hyperion (and the Oracle EPM ecosystem around it), and Anaplan across the areas that actually decide success: financial close and consolidation, planning and forecasting, scalability, governance, integrations, AI capabilities, user experience, implementation risk, and long-term maintainability.

The goal is not to crown one universal winner. The goal is to help you pick the platform that will lead for you in 2026-and still make sense in 2027.

Platform Overview

OneStream

OneStream is widely positioned as a unified enterprise finance platform: close and consolidation, planning, reporting, analytics, and data quality management living in one environment.

In 2026, the typical OneStream story is “reduce tool sprawl, reduce manual reconciliations, and standardize finance processes while still allowing business flexibility.”

Oracle Hyperion

Oracle Hyperion remains deeply embedded in large enterprises. Many teams run Hyperion on-premises, while others have moved or are moving to Oracle’s Cloud EPM modules. In 2026, Hyperion often represents a mature, heavily customized environment with proven processes.

The key question is whether to keep optimizing it, modernize it, or transition parts of it to Oracle Cloud EPM as your operating model evolves.

Anaplan

Anaplan is best known for connected planning: bringing multiple planning motions-finance, sales, supply chain, workforce-into one model so assumptions flow and scenarios recalculate quickly.

In 2026, Anaplan is commonly chosen when the biggest pain is planning speed, cross-functional alignment, and getting away from disconnected spreadsheets and siloed models.

What “Leading” means in CPM in 2026

In 2026, the leading CPM platform is not simply the one with the longest feature checklist. “Leading” usually shows up in day-to-day work like this:

- Your close is more controlled, but faster and you can trace numbers back without panic.

- Your forecast gets updated more frequently (monthly, bi-weekly, even weekly for some drivers).

- Scenario planning is easy enough that teams actually use it.

- Definitions stay consistent across the company: revenue, margin, headcount, and cash are not debated every month.

- Auditability and governance are built into workflows, not dependent on heroic individuals.

- AI features help with accuracy and productivity, without becoming a black box nobody trusts.

Let’s compare these platforms category by category.

Side-by-side Comparison Table (High Level)

| Area | OneStream | Oracle Hyperion | Anaplan |

| Primary strength in 2026 | Unified finance platform (close + consolidation + planning + reporting) | Mature enterprise CPM with long-running deployments; Oracle Cloud EPM modernization path | Connected planning across functions; fast scenario modeling |

| Best fit when… | You want to replace multiple CPM tools and standardize finance | You have a big installed base and deep customizations or align to Oracle roadmap | Planning and collaboration across business functions is the top priority |

| Consolidation focus | Strong contender for complex consolidations in a unified setup | Very strong and widely proven in enterprise environments | Often paired with a consolidation system rather than used as the primary consolidation backbone |

| Planning focus | Finance-led planning with strong governance and shared data foundation | Deep planning capabilities; approach depends on on-prem vs cloud direction | Rapid scenario planning and broad business participation |

| AI direction | Finance-focused AI initiatives; embedded AI features expanding | Broad Oracle AI story in cloud ecosystem; varies by module and roadmap | PlanIQ and connected planning improvements for forecasting and modeling |

1) Financial Close and Consolidation

If your finance reality includes multiple legal entities, multiple currencies, ownership structures, intercompany eliminations, and tight audit expectations, then close and consolidation cannot be treated as “just another module.” It is the foundation.

Here’s the practical way to compare in 2026: not “who can consolidate,” because all three can support finance processes, but “who gives you control, traceability, and speed with the least manual overhead.”

OneStream: Unified Close + Consolidation with a Single Finance Backbone

OneStream is often selected when the organization wants one controlled environment for close and consolidation and then wants planning and reporting on the same foundation. The appeal is less about flashy features and more about reducing fragmentation: fewer handoffs, fewer reconciliations between systems, and fewer “two versions of the truth” meetings.

In practice, finance leaders tend to like OneStream when they want:

- Standardized workflows across entities (close checklists, approvals, validations)

- Strong governance without forcing every business unit into the exact same level of detail

- A platform approach that reduces the number of separate CPM tools and specialized databases

A big advantage in many programs is organizational clarity: one platform, one set of rules, one place to manage the finance logic-rather than a patchwork of tools and spreadsheets.

Oracle Hyperion: Enterprise-grade Consolidation with Deep Legacy Footprints

Hyperion’s strength is the depth of real-world enterprise usage. Many organizations rely on it for statutory and management consolidation and have designed their finance operations around it for years.

Hyperion typically wins when:

- Your processes are already mature and heavily tailored

- Your team has strong internal Hyperion knowledge

- You require enterprise-scale consolidation and have already made the investment

However, the strategic decision is rarely “Hyperion or nothing.” It’s often:

- Keep optimizing on-premises Hyperion where it still fits

- Modernize or expand into Oracle Cloud EPM for newer requirements

- Reduce technical debt and simplify customizations over time

Anaplan: Consolidation is Possible, but it is not usually the Headline

Anaplan can support financial planning extremely well, but most organizations do not choose it as their primary statutory consolidation platform when consolidation complexity is the main problem to solve. In 2026, Anaplan is more commonly used for connected planning, while consolidation continues in a consolidation-focused system.

If your consolidation needs are lighter, Anaplan can still be part of the solution. But if consolidation is your core pain, Anaplan usually plays a supporting role rather than the primary backbone.

Takeaway for Close & Consolidation

- If consolidation is your heartbeat, OneStream and Hyperion are more likely to be the core contenders.

- If planning is your transformation engine, Anaplan may lead the broader effort-but you may still want a consolidation backbone elsewhere.

- Many enterprises in 2026 run a hybrid approach, using the best tool for each job while keeping definitions aligned.

Unify workflows and eliminate reconciliations with a proven OneStream implementation approach.

Optimize My Close

2) Planning, Budgeting, and Forecasting

Planning is where CPM platforms either become loved-or quietly ignored.

A platform can be technically “capable,” but if it is too slow, too rigid, or too dependent on a small admin team, business users will drift back to spreadsheets. In 2026, planning success is about speed, adoption, and quality of decision-making-not just modeling features.

Anaplan: Connected Planning as a Competitive Advantage

Anaplan’s biggest reputation advantage is connected planning. The platform is designed so that different planning processes can be connected in one model and recalculated quickly as assumptions change.

In 2026, Anaplan often leads when:

- Multiple departments must collaborate on one plan (finance, sales, supply chain, workforce)

- You need rapid what-if scenarios and frequent re-forecasting

- You want planning to be driven by business users, not limited to the FP&A team

This is also where Anaplan’s forecasting capabilities and calculation engines matter. PlanIQ is positioned as an AI/ML-based forecasting capability within the platform. Polaris is positioned as a calculation engine designed for sparse models and greater dimensionality at scale.

The practical implication: if your planning needs are cross-functional and scenario-heavy, Anaplan often gives teams the speed and participation they need to keep the planning cycle alive throughout the year.

OneStream: Finance-led Planning with Strong Governance

OneStream tends to be a strong fit when planning must stay tightly anchored to finance truth: the chart of accounts, consolidation structures, and consistent definitions across the enterprise.

In 2026, OneStream planning programs often win when:

- The organization wants to align planning and actuals under a single finance foundation

- Governance and auditability are non-negotiable

- Planning needs to connect seamlessly to close and consolidation outcomes

This is a different leadership style than connected planning. Anaplan often leads with “speed and collaboration.” OneStream often leads with “finance control and unified truth.” Both can work, but they create different operating models.

Oracle Hyperion: Mature planning-decision Depends on Roadmap

Hyperion planning has years of enterprise maturity and is still used widely. In 2026, the planning conversation is often less about whether Hyperion can do planning (it can), and more about long-term direction.

If your organization is aligned with Oracle’s broader ecosystem, Oracle Cloud EPM planning modules can be part of a modernization story. If you are staying on-premises, you may still be fine, but you should actively manage technical debt, talent availability, and integration complexity.

2026 Takeaway for Planning

- If you need planning across functions with rapid scenarios, Anaplan often leads.

- If you need planning anchored to finance close and consolidation with strong governance, OneStream often leads.

- If you already run Hyperion and it works, it may remain the most practical choice-unless modernization goals or adoption challenges push you toward change.

Also Read: Benefits of OneStream Unified CPM Platform

3) Data Model, Scalability, and Performance

CPM projects don’t fail because “the platform can’t do planning.” They fail because the model becomes too slow, too complex, or too hard to maintain once real business detail shows up.

Scalability is not just about handling more users. It’s about handling:

- More versions (scenarios, rolling forecasts)

- More dimensions (product, customer, channel, geography, project)

- More granularity (weekly, daily drivers)

- More integration sources (ERP, CRM, HRIS, data lakes)

Anaplan: Fast Recalculation and Engine choice

Anaplan is built around an in-memory calculation engine (Hyperblock) that recalculates dependencies as inputs change. This is why users often experience Anaplan as “fast for scenarios.” For larger, sparser models, Anaplan’s Polaris engine is designed to store and calculate sparse datasets and can improve potential size and dimensionality when used correctly.

In human terms: if most of your planning cube is empty (which is common in detailed planning), a sparse-friendly engine can matter. It can reduce memory waste and improve performance-if the model is designed well.

OneStream: Scalability through a Unified Finance Design

OneStream’s scaling story often comes from unification: fewer systems to reconcile and fewer data movements. When designed properly, the platform can handle enterprise finance needs while allowing teams to extend beyond finance into operational metrics.

In 2026, many organizations choose OneStream to reduce the friction created by multiple CPM tools, not only to increase technical performance. That said, the best results still depend on design discipline: clear dimensional strategy, controlled data loads, and good governance business rules.

Oracle Hyperion: Performance Depends on How it has been built and Maintained

Hyperion can run really well, but speed and stability depend on the way it was originally set up and how much it has been modified over time. In many companies, the system started clean, and then years of changes new rules, new reports, quick fixes, new integration slowly added weight.

The common reasons Hyperion feels slow are:

- Old custom scripts that only one or two people understand.

- Integration that kept getting “patched” instead of redesigned.

- Using Hyperion for jobs it wasn’t set up for at the beginning.

4) Governance, Auditability, and Controls

Finance leaders care about speed, but they care about trust even more. A plan that updates fast but can’t be explained will not survive the first hard executive review.

In CPM, governance includes:

- Who can change drivers and assumptions

- How approvals work

- Traceability from plan to actuals

- Workflows and close tasks

- Audit trails and documentation

- Consistent definitions across the company

OneStream: Strong Governance as a Core Design Goal

OneStream is often favored by finance teams that want governance and auditability baked into a unified finance backbone. This includes controlled workflows and standardized logic for finance processes.

In 2026, OneStream programs often succeed when the CFO wants:

- Fewer manual steps

- Fewer spreadsheet approvals

- Less dependence on tribal knowledge in the close process

Oracle Hyperion: Governance is Strong, Especially in Mature Deployments

Hyperion deployments in large enterprises can be highly governed, especially when they have been running for years. Many teams have strong processes and controls built around Hyperion.

The trade-off in 2026 is that governance sometimes comes with rigidity. If business users feel planning is “too controlled” and slow to adjust, they may create shadow models outside the system.

Anaplan: Governance is Possible, but Requires Operating Discipline

Anaplan can support governance, but in practice it demands clarity on ownership and definitions because Anaplan enables broad participation, teams must invest in:

- Master data management

- Clear metric definitions

- Role-based access and workflow practices

- Controlled model changes

When those are in place, Anaplan becomes a powerful, trusted planning hub. When they aren’t, it can become a “fast spreadsheet” where disagreements simply move faster.

5) Integration and Data Management

Whether you run SAP, Oracle ERP, Dynamics, NetSuite, Workday, Salesforce, Snowflake, or a custom data lake, your CPM success depends on how well data flows in and out-reliably and transparently.

What matters most:

- Stable inbound data loads (actuals, HR, sales, operational drivers)

- Mapping and transformation rules that are understandable

- Reliable outbound feeds (reports, dashboards, BI, management packs)

- Monitoring so failures don’t become “month-end surprises.”

Practical Differences you will See:

- In a unified-finance approach (common with OneStream), you often aim to centralize and standardize finance data logic in one place.

- In connected planning (common with Anaplan), you often prioritize flexible data flows to support cross-functional drivers and frequent updates.

- In long-running Hyperion environments, integration complexity can grow over time; modernization efforts often start by simplifying data pipelines and reducing custom code.

We design secure, audit-ready OneStream integrations for SAP, Oracle, NetSuite, and more.

Fix My Integrations

6) Reporting and Analytics

Reporting is the critical foundation for leadership to make effective decisions and they expect:

- Self-service exploration

- Consistent KPIs across teams

- Drill-down to details when numbers are challenged

- Narrative clarity: what changed, why it changed, and what we are doing next.

All three platforms can support reporting, but your experience will vary depending on how you implement and what your business expects. The bigger risk is not the platform-it’s building reports without aligning on definitions and ownership.

7) AI in CPM: Real Help vs. Hype

AI is now a standard part of CPM conversations. But finance adoption has one strict rule: if it cannot be explained, it will not be trusted.

The most useful AI use cases in CPM tend to be:

- Forecast Assistance (suggested projections, driver-based models)

- Anomaly Detection (flagging unusual variances)

- Commentary Support (help drafting narrative explanations)

- Productivity Tools (search, analysis, optimization)

- Scenario Recommendations (what levers drive the result)

OneStream: Sensible AI Direction focused on Finance Workflows

OneStream’s SensibleAI initiatives are positioned around automating demanding finance tasks and improving forecasting productivity. In 2026, the messaging focuses on combining predictive techniques with generative AI elements and embedding these into finance workflows. This direction appeals to finance teams who want AI to live inside controlled processes rather than as a separate experiment.

Anaplan: PlanIQ for AI/ML Forecasting + Connected Planning Context

Anaplan’s PlanIQ is positioned as an AI/ML-driven forecasting capability designed to use internal and external data to produce trusted predictions. The key advantage is context: if forecasts are generated within the same connected planning model, business teams can act on them quickly and test scenarios immediately.

Oracle: AI Story ties into Cloud EPM and broader Oracle Ecosystem

Oracle positions Oracle Fusion Cloud EPM as having AI embedded throughout its platform. For organizations already aligned to Oracle’s stack, this matters because finance planning and close can connect more directly to Oracle’s broader data and application ecosystem.

8) Cost and ROI

Most CPM decisions are not won by licensing costs alone. They are won by ROI clarity.

The strongest business cases usually tie ROI to:

- Fewer close days

- Fewer manual reconciliations and spreadsheet controls

- Fewer forecasting cycles spent “rebuilding models”

- Improved forecast accuracy and faster decision-making

- Reduced dependence on a small number of key individuals

- Better audit readiness

A simple way to frame ROI is: What can we stop doing to save time or money?

If your CPM project doesn’t remove work, it won’t feel like a win no matter how advanced the platform is.

9) Implementation Realities: Timelines, Risk, and Adoption

Implementation success depends less on the platform and more on operating discipline. The common failure patterns are consistent across tools:

- Scope that keeps expanding

- No ownership of master data and definitions

- Underestimating change management and training

- Designing for perfect future-state and ignoring what teams can adopt now

- Treating CPM as “IT’s project” instead of finance’s operating model

The most successful programs do three things well:

1) They start with a clear business outcome (faster close, better forecast cadence, fewer reconciliations).

2) They deliver value in phases rather than waiting for a giant launch.

3) They invest in adoption: training, documentation, governance, and support.

Which Platform Leads in 2026? A Decision Guide by Scenario

Scenario A: Close and Consolidation Pain is the Top Priority

If the biggest problem is close and consolidation (complex ownership, inter company, audit pressure, inconsistent entity processes), then leadership usually favors a platform where consolidation is a core strength and governance is strong.

Likely leaders:

- OneStream (unified finance backbone approach)

- Oracle Hyperion (mature enterprise consolidation, especially if you already run it)

Anaplan may still be used but typically for planning, with consolidation handled elsewhere.

Scenario B: Planning is Broken because it’s Disconnected

If your biggest pain is planning chaos teams sending spreadsheets, definitions changing, scenarios taking days then connected planning becomes the leadership factor.

Likely leader:

- Anaplan, especially when planning spans finance + sales + supply chain + workforce

OneStream can still be a strong planning platform, especially for finance-led planning, but Anaplan often leads when broad participation and rapid scenarios are the core requirement.

Scenario C: You want to Replace Multiple CPM tools with One Platform

If your organization is tired of tool sprawl-separate systems for consolidation, planning, reporting, and data quality-then a unified platform approach is attractive.

Likely leader:

- OneStream, when the goal is simplification and standardization under one finance platform

Oracle can also support unified outcomes via Cloud EPM modules, but the path depends on your Oracle roadmap and current footprint.

Scenario D: You have Hyperion and it works-should you change?

Many organizations keep Hyperion because it still works and is deeply embedded in their processes. The more practical question is not “rip and replace,” but “modernize with intention.”

Good reasons to keep Hyperion (for now):

- It is stable and heavily tailored to your processes

- Your team has strong internal knowledge

- The cost and risk of change outweigh the near-term benefits

Good reasons to modernize or migrate:

- Planning adoption is low and the business runs shadow models

- Technical debt is high and custom code is hard to maintain

- You want cloud agility, faster innovation cycles, or broader connected planning

A smart approach can be incremental: modernize integrations and governance first, then evaluate where a platform change truly adds value.

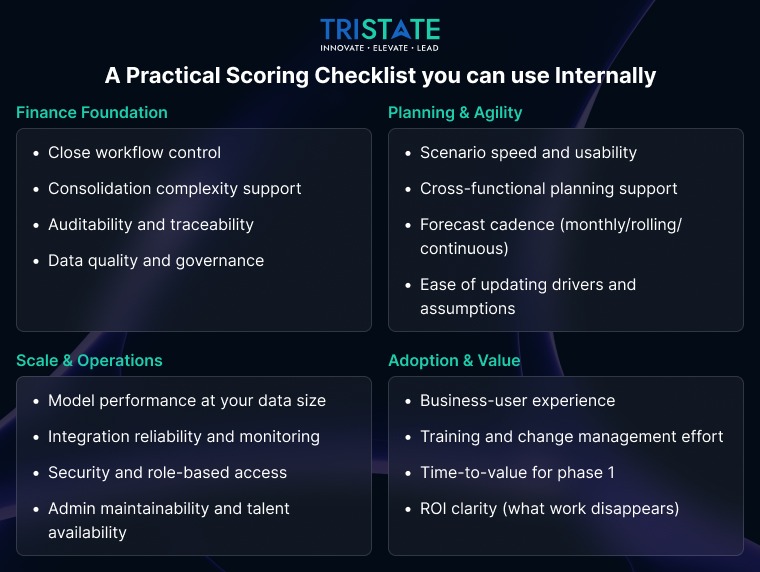

A Practical Scoring Checklist you can use Internally

When teams argue about CPM, it helps to score platforms against the factors that matter to your organization. Use a simple 1–5 score for each item and avoid debating features in abstract.

Finance Foundation

- Close workflow control

- Consolidation complexity support

- Auditability and traceability

- Data quality and governance

Planning and Agility

- Scenario speed and usability

- Cross-functional planning support

- Forecast cadence (monthly/rolling/continuous)

- Ease of updating drivers and assumptions

Scale and Operations

- Model performance at your data size

- Integration reliability and monitoring

- Security and role-based access

- Admin maintainability and talent availability

Adoption and Value

- Business-user experience

- Training and change management effort

- Time-to-value for phase 1

- ROI clarity (what work disappears)

The highest scoring platform is usually the one that “leads” for you in 2026.

How to Choose an Implementation Partner (Where most ROI is won)

Choosing the right platform is only half the decision. The other half is implementation quality.

In CPM, your partner influences:

- Architecture and model design choices (which affect performance for years)

- Governance and workflow design (which affects trust)

- Integration reliability (which affects month-end stress)

- And training/adoption (which affects whether people use the system)

If you are searching for the Best OneStream Implementation Company, don’t just evaluate tool skills evaluate finance process capability. A true OneStream Consulting Company should be able to speak fluently about close, consolidation logic, planning calendars, controls, and how to reduce manual effort across the month.

And if you already have OneStream but need speed, you may prefer to Hire OneStream Experts for targeted work: performance tuning, business rule optimization, integration stabilization, or a redesign of planning workflows. This can deliver fast wins without starting a large transformation program.

Recommended Approach to Make the Decision (Simple, Low-risk)

Here is a low-risk way to decide in 2026 without committing to a giant bet too early:

Step 1: Run a short Discovery Workshop (1–2 weeks)

- Map your current close and planning flows

- Identify where manual work and reconciliation happens

- Define a small set of success metrics (close days, forecast cycle time, accuracy)

Step 2: Build a Proof-of-value Prototype (4–8 weeks)

- Use one entity group or one business unit

- Load real data and run one close cycle or one forecast cycle

- Validate performance, usability, and governance

Step 3: Launch Phase 1 with a tight scope (8–16 weeks)

- Deliver the outcome that pays back fastest

- Build the foundation for later phases

- Train the people who will live in the system every month

Step 4: Expand in Phases

- Add additional entities, drivers, and reports

- Add advanced forecasting and AI features after the foundation is stable

- Keep governance strong as usage expands

Get a clear, no-obligation assessment of your current CPM landscape and next steps.

Get Free CPM Assessment

Conclusion:

The Platform that leads is the one your teams can run every month

OneStream, Oracle Hyperion and Anaplan can all be “best,” depending on what you need most.

- OneStream often leads when you want a unified finance backbone-close, consolidation, planning, and reporting under one controlled platform.

- Oracle Hyperion often leads when you have a mature enterprise footprint, deep customizations, and a roadmap aligned with Oracle’s ecosystem and support model.

- Anaplan often leads when connected planning and cross-functional scenarios are the heart of the transformation.

The real winner is not the tool. It’s the outcome: a faster close, a stronger forecast, fewer manual steps, and a finance team that spends more time advising the business-and less time stitching spreadsheets together.

If you want help mapping your situation to the right platform decision, TriState Technology can support evaluation, architecture, implementation, and ongoing optimization so your CPM investment delivers real, measurable value.