Finance teams are being asked to do two things at the same time: close faster and guide the business forward with confidence. It becomes difficult when the finance systems are all over the place like consolidation in one tool, planning in another, reporting in spreadsheets, and data reconciliation happening through email.

Many CFO are moving toward a unified Corporate Performance Management (CPM) approach where close, consolidation, planning, and reporting work together on a single platform. The platform becomes the “finance backbone” that supports day-to-day execution, strategic decision-making, forecasting and scenario planning.

Table of Contents

Why Finance Needs a “Backbone” Now More Than Ever

A few years ago, finance teams could manage with shortcuts and workarounds. But now, that’s becoming almost impossible because:

- Businesses change faster-pricing, demand, supply, competition, everything is shifting.

- Leaders want answers instantly, often with different scenarios to compare.

- Data has exploded, especially with multiple ERPs, acquisitions, and more detailed reporting.

- Finance teams are expected to do more with fewer resources, while audit and compliance demands keep increasing.

A strong finance backbone is no longer optional. It’s what helps finance teams move fast without losing control.

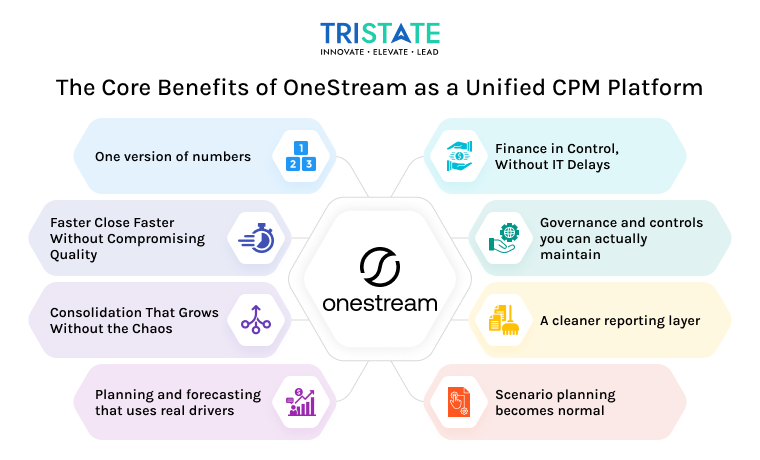

The Core Benefits of OneStream as a Unified CPM Platform

1) One Version of Numbers

When consolidation, planning, and reporting all run on the same system, finance teams stop spending days arguing about which report is correct.

What improves:

- Same dimensions everywhere (entity, account, cost center, product, customer)

- Standard business rules

- Clear traceability of where each number comes from

What it feels like: fewer last-minute fire drills, fewer “can you re-run this?” requests, and much more confidence in the numbers

2) Faster Close Faster Without Compromising Quality

Closing faster isn’t just about speed but it is also about repeatability and control. A unified platform helps by automating routine steps and standardizing workflow.

Common outcomes will be:

- Better visibility into close progress

- Reduced manual checks and follow-ups

- Stronger ownership and accountability (who approves what, when)

Even small improvements-like standard validations or removing spreadsheet-based consolidation steps-can reduce month-end pressure significantly.

3) Consolidation That Grows Without the Chaos

In many finance teams, consolidation depends on a few experts who know all the rules, mappings, and workarounds. When the business grows or those experts are busy or unavailable-everything slows down and becomes risky. OneStream removes that dependency.

With OneStream’s unified CPM platform:

- Consolidation rules are built once and reused everywhere

- Everything is documented, consistent, and easy to maintain

- Data quality checks are automated, not manual

- Every number is traceable and auditable

- Adding a new entity or acquisition is a configuration task, not a crisis

As the organization expands, OneStream scales with it-no messy spreadsheets, no last-minute heroics, and far fewer errors. Finance can focus on analysis instead of firefighting.

4) Planning and Forecasting that Uses Real Drivers

Traditional budgeting often becomes a yearly ritual such as updating last year’s numbers, negotiating targets, and locking the file. Modern planning is driver-based and scenario-ready.

A OneStream unified platform makes it easier to connect operational drivers to financial outcomes, for example:

- Volume changes → revenue impact

- Headcount plans → cost impact

- Capacity shifts → margin impact

- Price strategies → profitability impact

Result: forecasting becomes a management tool, not just a finance deliverable.

5) Scenario Planning Becomes Normal

Most leadership teams want scenarios, but finance avoids them because spreadsheet scenario modeling is fragile and time-consuming.

With a unified CPM model, scenarios become easier to run and compare, such as:

- Best case / base case / downside

- Region-wise shocks

- Input cost changes

- Sales pipeline conversion shifts

6) A Cleaner Reporting Layer

When reporting pulls from the same governed model used for close and planning, you reduce report chaos and inconsistent definitions.

What improves:

- Standard KPI definitions

- Consistent business logic

- Role-based access

- Faster report updates

7) Governance and controls you can Actually Maintain

Governance isn’t exciting-until it’s missing. A unified platform makes it easier to enforce:

- Role-based security

- Approval workflows

- Data validations

- Audit trails

- Standard change management

This is especially valuable for regulated industries and teams with strong audit needs.

8) Finance in Control, Without IT Delays

In many organizations, finance depends heavily on IT or external vendors to make even minor changes. That slows everything.

A well-designed OneStream setup gives the right balance between what Finance can manage on its own and what IT should control. Finance can handle day-to-day changes like updating hierarchies, adding new accounts, tweaking business rules, or adjusting workflow steps without raising IT tickets or waiting days for support. This gives Finance more agility and independence.

Meanwhile, IT focuses on the areas where their expertise matters most: integrations with ERPs and data sources, platform performance, user management, and security controls. This ensures the system stays stable, reliable, and compliant as the business grows.

This balance is exactly why a unified CPM platform like OneStream becomes the “backbone” of modern finance. It stays flexible for business users, secure for IT, and ready to adapt as the organization’s needs evolve over time.

We deliver end-to-end OneStream solutions with proven success frameworks and ongoing support.

Book a Free Consultation

What a “Unified Finance Cycle” Looks Like in Practice

Here’s what changes when finance processes are truly connected:

- Data comes in from ERP(s), CRM, HR, and operational systems through governed integrations.

- Validations run automatically (missing entities, incorrect mappings, out-of-balance checks).

- Close workflows guide the team with tasks, approvals, and status visibility.

- Consolidation runs consistently (eliminations, currency translations, ownership logic).

- Reporting is generated from the same model used for close and consolidation.

- Forecasting leverages actuals immediately-no manual rebuilding of the forecast base.

- Scenarios are tested using the same rules and dimensions, so comparisons are meaningful.

That’s the backbone effect: each process supports the next instead of creating rework.

Who Gets the Most Value From a Unified CPM Platform?

A unified CPM platform like OneStream is especially valuable for companies whose finance teams feel stretched, overloaded, or constantly fixing numbers. It helps the most when the organization has any of these challenges:

1. Multiple Entities or Regions:

If your company has several business units, subsidiaries, or operates in different countries, keeping track of finance becomes complicated.

A unified platform brings everything into one place, so you don’t have different versions of the truth floating around.

2. Multiple ERPs or Frequent Acquisitions

When different parts of the company use different accounting systems (SAP in one region, Oracle in another, Tally somewhere else), the data doesn’t line up easily.

A unified CPM platform standardizes everything so finance doesn’t spend days cleaning and aligning data every month.

If the company acquires other businesses regularly, this becomes even more important-new entities plug in faster.

3. Intercompany Complexity

When two group companies buy or sell to each other, the numbers often don’t match. Someone ends up chasing teams for corrections.

A unified CPM platform automates intercompany eliminations and matching, reducing back-and-forth emails.

4. High Audit and Compliance Requirements

If your business is regulated or has strict audit expectations, you need clear data lineage, consistent rules, and traceability.

A unified CPM platform makes audits smoother because every number has a clear source and path.

5. Need for Rolling Forecasts and Scenario Planning

Leaders today want answers quickly-

“What if revenue drops 10%?”

“What if we hire 50 more people?”

“What if we expand to a new region?”

A unified platform lets finance create forecasts and scenarios in hours instead of weeks.

Final Thoughts

Finance shouldn’t be spending its best talent reconciling spreadsheets and rebuilding forecasts from scratch every month. A unified CPM platform is one of the most practical ways to move finance from “reporting the past” to “steering the future.” That’s why OneStream increasingly acts like a modern finance backbone: it connects close, consolidation, planning, and reporting in a way that can scale with the business without losing control.

If you’re looking for a partner, choose a team that truly understands OneStream implementation. And if you want to strengthen your capabilities, it may be the right time to Hire OneStream Developers through trusted OneStream Partners who can support, manage, and grow your platform for the long term